Art: The Alternative Real Asset

The recent global turmoil has led many investors to reconsider real assets as part of their portfolio allocation. Real, or sometimes called tangible assets, include those linked to physical assets: land, real estate, natural resources, commodities and precious metals, among others. Many real asset classes are accessible by investors today through a wide variety of financial products, including exchange-traded funds (ETFs), closed-end funds, REITs, private equity-like vehicles, and derivatives. Among these, gold is the classic example of a real asset and often thought of as a “safe haven” asset during market dislocation and recently referred to as “the currency of last resort” by Goldman Sachs.

But notably absent from the usual list of real assets is art. Art is similarly a real asset that tends to behave unlike any other from an investment standpoint. Art is a physical, tangible asset that is globally transportable, marketable, and can be transacted in any currency; and there is no better market environment than today’s to illustrate art’s value as the alternative real asset in any investment portfolio.

There is an estimated $1.7 trillion worth of art held in private hands globally, of which nearly $70 billion changes hands each year, and until recently, investor access was limited almost entirely to physical ownership. Art as an asset class is vast, global, and today through Masterworks, accessible to the investing public.

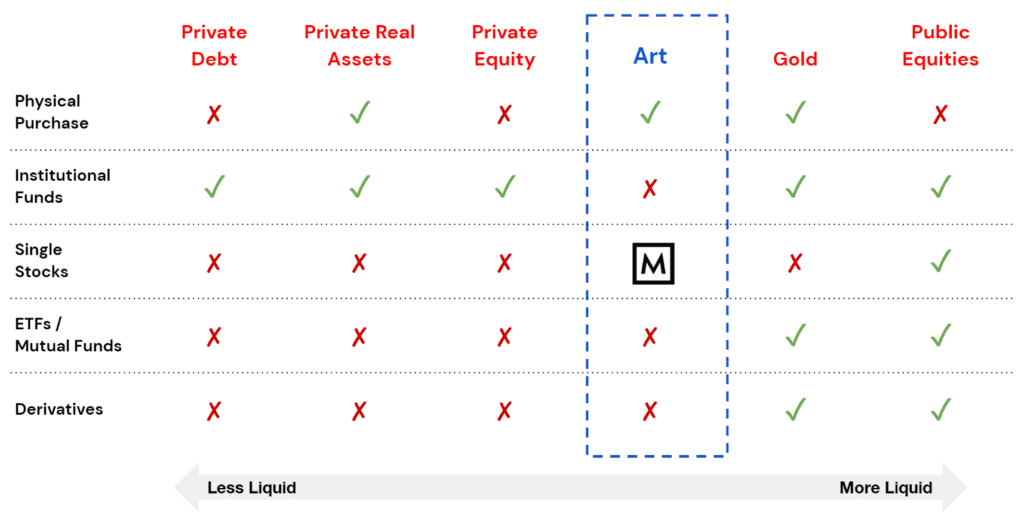

Ways to Access Various Asset Classes

Performance

Real asset performance generally reflects capital appreciation over time rather than an expected earnings or dividend stream. Specific types of real assets are sensitive to different types of economic forces. Gold tends to be a hedge against changes in inflation expectations. Commodities, such as oil or agricultural goods, tend to reflect demand as a factor of production (e.g., oil consumption by the transportation sector). By contrast, art is an asset with scarcity value that tends to reflect the increasing purchasing power of ultra-high-net-worth individuals, which has been growing steadily for decades. As a result, art tends to be less sensitive to the economic factors that impact other real assets.

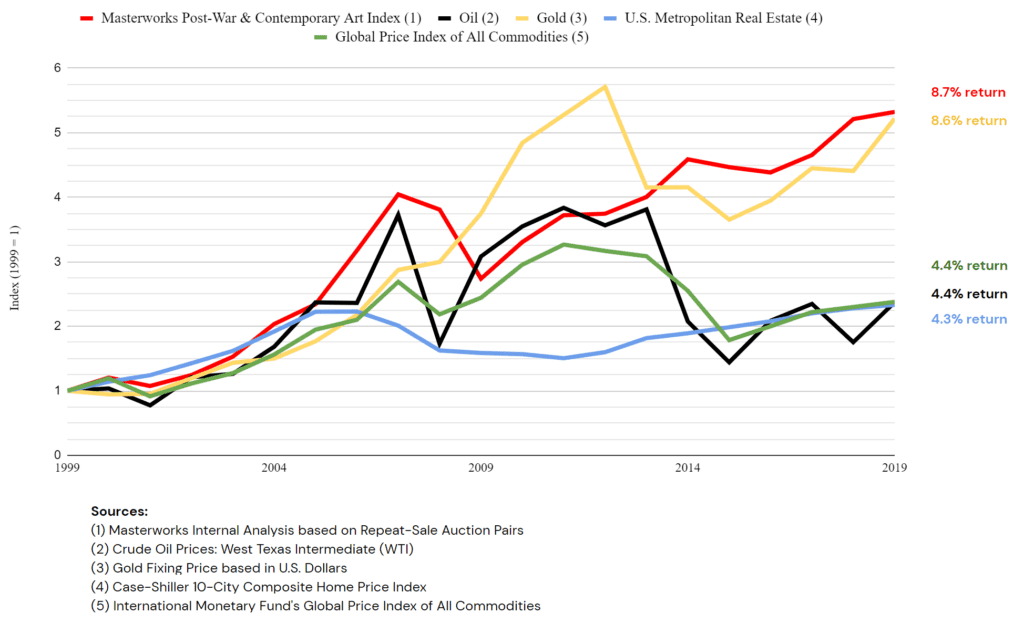

Over the past 20 years, art (as measured by the Masterworks Post-War and Contemporary Index) has appreciated 8.7% annually with a consistent growth over the period with the only meaningful decline occurring during the 2008 financial crisis followed by a V-shaped recovery.

20-Year Performance – Art versus Selected Real Assets

While gold had a comparable 20-year annual return of 8.6%, its interim performance was far more sensitive to changes in inflation expectations during the period. The significant run-up in the aftermath of the financial crisis reflected heightened inflation expectations as global central banks engaged in quantitative easing. However, as inflation expectations fell after 2012, gold’s performance suffered comparably to other commodities, while art returns continued to climb.

Interestingly, art appears to behave similarly to a leveraged position on metropolitan real estate – delivering nearly 2x the returns over 20 years. While real estate is among the world’s largest asset classes, art has the distinct advantage of being readily transportable (and therefore marketable anywhere) and currency neutral (can be transacted in any locale), both of which greatly increase opportunities for liquidity, all else equal.

Correlation

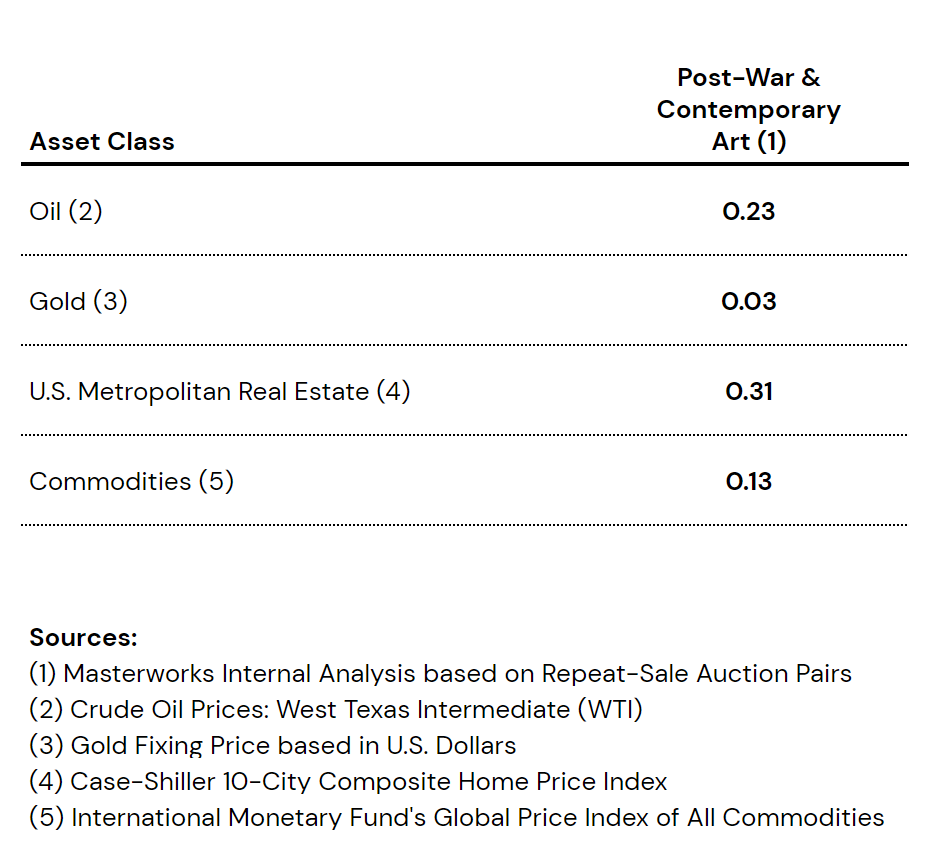

The district economic drivers for art vs other real assets results in remarkably low correlation factors. Correlation generally measures how two assets move in concert with one anther (e.g., 1 = they move exactly alike, -1 = they move in opposite directions and 0 = their movements are not tied to one another).

Relative to gold, the correlation factor for art is 0.03, implying they are virtually unconnected to one another. While relative to major-metro area real estate, the correlation factor is 0.31, supporting the argument that art behaves similarly to a leveraged position on real estate in global metropolitan areas, such as New York, San Francisco, Los Angeles, etc (which in turn reflects ultra-high-net-worth wealth growth).

The most important advantage of low correlation is the ability to reduce volatility in a diversified portfolio. Based on these correlation factors, adding art as an allocation alongside other real assets would help achieve this critical benefit, particularly in today’s tumultuous economic environment.

Outlook During the COVID Crisis

Amid the current COVID-19 crisis, we expect real assets, gold in particular, to garner significant investor interest now that interest rates have fallen once again to historic lows. We believe art similarly merits strong investor consideration alongside other real assets based on its historical track record and attractive low correlation over the past 20 years, including during the dot-com and financial crises. Anecdotally, the demand for investment-grade art remains robust, particularly as investors seek shelter from recent carnage in equity and fixed income markets, and auction houses are already re-positioning their next sales for as early as this summer. As a result, we expect investors in art, a global asset untethered to traditional asset classes, to be well-positioned over the long-term.