David Geffen and the Business of Art Investing

American business magnate and entertainment tycoon David Geffen is not just music and films. As it turns out, he is also greatly fascinated with arts: the collection of American artists’ mid-century and contemporary work to be exact.

But what makes him one of the most regarded art collectors today is his impeccable taste and timing.

Reputable art dealers like Richard Polsky and art curator Paul Schimmel have both expressed their admiration of Geffen’s collection, citing his “intuitive sense of quality” and decision to buy only a few valuable art pieces rather than invest in a much larger collection like most art collectors of his scale.

Consistently recognized as a top collector globally, David Geffen holds the most valuable art collection owned by a single person, worth $2.3 billion. His influence in the industry was mainly because of his reputation as a smart collector — buying the most coveted and unobtainable art pieces and selling them at the perfect timing.

Art as an Investment

After amassing valuable works of art early on, Geffen sold $65 million in art at a private auction. Some believed the sold pieces include Jasper Johns‘ O through 9, Willem De Kooning‘s Clam Digger, Jackson Pollock‘s No. 8, 1950, and Robert Rauschenberg‘s Winter Pool.

In 2006, he sold $420 million in art, including Willem de Kooning’s Police Gazette and Woman III, Jasper Johns’ False Start, and Jackson Pollock’s Number 5, 1948—sold for $140 million alone to Mexican financier David Martinez. The sale broke the record as the most expensive painting ever sold at that time, overtaking previous record-holder, $134 million Portrait of Adele Bloch-Bauer I of Gustav Klimt.

In 2016, he made $1 billion in selling art, including the sale to fellow collector Kenneth Griffin who bought two of his art collections—De Kooning’s Interchanged and Pollock’s Number 17A for $500 million.

In 2020, before the pandemic hit, Geffen sold his Beverly Hills mansion to another business magnate, Amazon’s Jeff Bezos, for $165 million and then bought David Hockney‘s The Splash for $30 million at a London’s Sotheby’s auction.

This art selling and buying are only on top of what Geffen earns as a founder of Asylum Records, Geffen Records, and Dreamworks Animation. The 79-year-old producer and film executive was born to Jewish immigrants in Brooklyn. He started his career in the mailroom of talent agency William Morris and climbed up the corporate ladder to become an agent. Today, Geffen has become a self-made billionaire who has invested his money in accumulating real estate and art.

He now sits at the 71st Forbes 400 list for 2021, with an estimated net worth of $10.4 billion. Wealth X, a data-driven intelligence on the world’s wealthiest individuals, reported in 2013 that Geffen owns the most valuable art collection in the world—even after selling the most coveted ones years ago. His collection was estimated to be worth $1.1 billion at that time. Today, it is estimated to be worth at least $2.3 billion.

Beyond art business and investments, he is a well-known art philanthropist with connections to the world’s top museums and galleries. In 2017, Geffen pledged $150 million to the Los Angeles County Museum of Art, the largest gift in the museum’s history. His name is also on the Museum of Contemporary Art’s Geffen Contemporary. He also has ties to the Museum of Modern Art, where he donated $100 million in 2016.

Building an Art Collection

David Geffen is known as a very private art collector. He rarely—almost never—let others borrow his acquisitions, even by art museums and galleries he supports and donates to.

He is mostly interested in abstract expressionist and pop artworks. His collection is mostly of Pollack, De Kooning, Johns, Rauschenberg, and Hockneys.

Although he has sold at least one or two works of these artists, it is believed that he still owns more important works by them and is still considered one of the most impressive private art collections in the world.

While it is said that his current collection is only less than 50—a small one compared to the collections of other billionaires—his impeccable eye and taste for art, coupled with his deal-making skills, has earned him exceptional and often unobtainable works.

One of the most memorable stories of his art-chasing was in 1994 when Geffen arranged a swap with the Iranian government to provide them with a precious Persian manuscript in exchange for selling a de Kooning from the Tehran Museum’s legendary collection.

Today, only a few of David Geffen’s known art investments are known to the public:

Jasper Johns’ “Target with Plaster Casts” (1955)

Acquired in 1993 from Leo Castelli for $13 million

Jasper Johns’ “Out the Window” (1959)

Acquired in 1986 at the Sotheby’s Auction for $3.63 million

David Hockney’s “The Splash” (1967)

Acquired in 2020 at Sotheby’s auction for $30 million

Is Art Only for the Ultra-Wealthy?

In David Geffen’s case, art collecting is not necessarily for the rich only. Most of his postwar works were bought in the 90s when he was quietly building his collection of paintings and spending only a few dollars on each of them. Over the years, their value accumulated, and their assets diversified. From being just a collector, he has now become smarter with his acquisitions and sold a few of the most prized paintings in the art world today.

Like Geffen, your taste and judgment on what artwork to buy will improve over the years.

Educating yourself about art history and current trends could also help you make smart purchases on arts.

Opportunities may also exist in investing in emerging and promising artists or buying from up-and-coming art galleries.

Since art is generally a conservative community, it would be good to forge a relationship with art professionals and join collectors groups.These people can help you build connections, and guide you on your art investment plans.

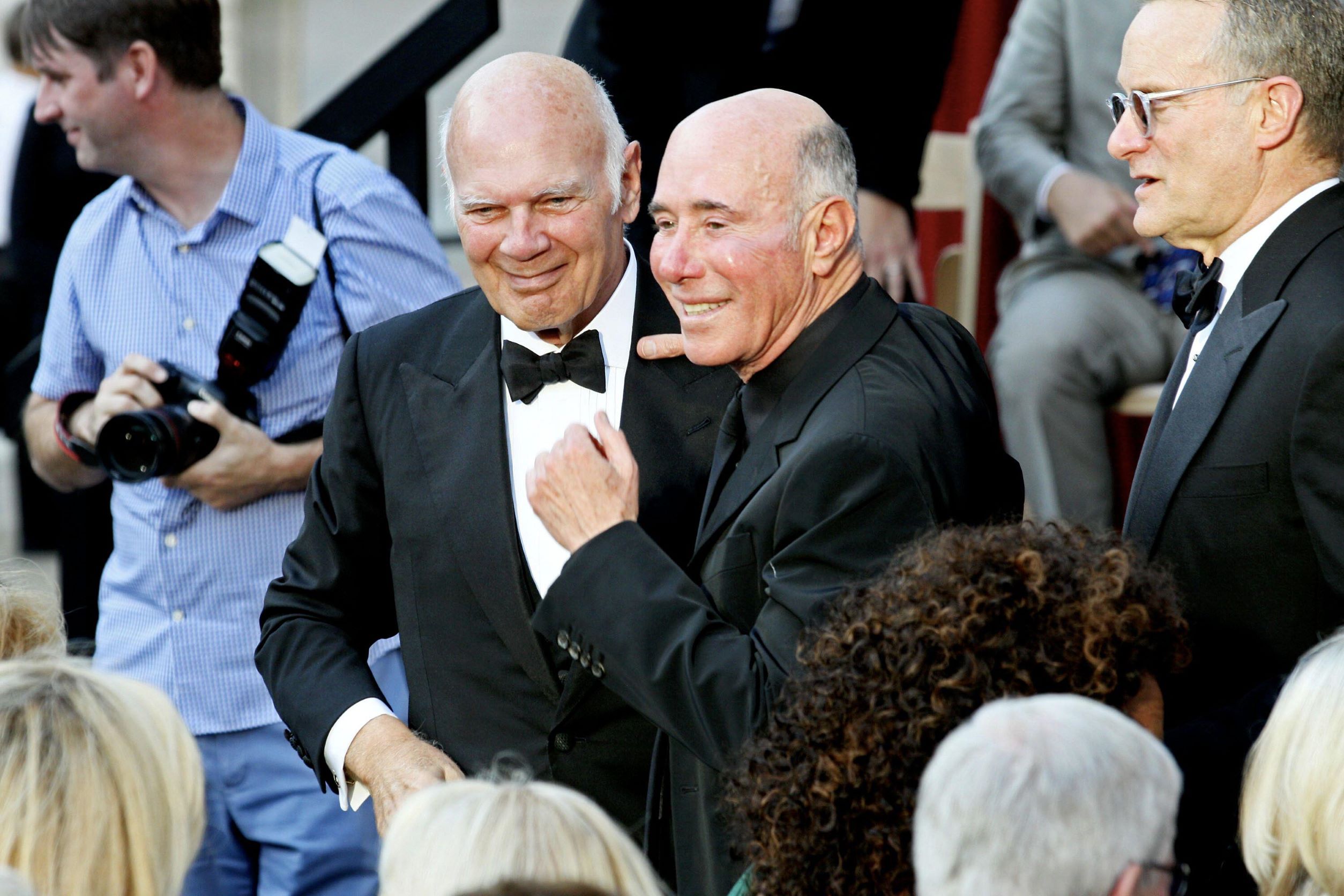

These were how Geffen made his mark in the art world and became one the most powerful and influential art collectors today. For years, he has been a familiar figure at New York contemporary art auctions, often appearing in casual clothes with dealer Larry Gagosian at his side, serving as his art adviser.

What to Consider When Investing in Art

Art is often a long-term passion investment—an asset that one can enjoy while you wait for it to accumulate in value. Many institutional and retail investors add art to their portfolio as part of their alternative investment asset allocation, especially for those keen on the arts and interested in the industry.

However, art is a long-term investment. Sizable profits from art start accruing in 7 years. Investors like David Geffen often wait at least a decade before they decide to keep or sell an art piece. If you’re looking for shorter-term investments, art investing may not be right for you.

Art prices tend to be segmented by medium, movement, and artist. Oil paintings on canvas, contemporary art, and blue-chip artists tend to be the least volatile; however, these paintings can cost upwards of 7 figures. For those who do not have multiple millions of dollars they are willing to lock up in a painting for 7-10 years, you can do research on share-based art investing.

Historically, investments in art tend to have a low correlation to equities, which could makes it a good diversification for an investment portfolio.

Like Geffen, most art investors start as collectors. Appreciation and interest in arts can become an asset, as shown by many top art collectors globally. While art investing is usually reserved for art lovers and enthusiasts, the potential for financial gains can be a motivation to invest.

Excitingly, potential valuable art pieces can be bought anywhere—from auctions, galleries, even in antique shops. However, having the basics in place before investing in art can be of great help. Liking an art piece because it is beautiful is not enough. For astute art investors, the background and the future of the artwork and its artists are major considerations.

Blue-chip names such as Picasso, Kaws, and Basquiat have become powerhouses in the global art market; however, there could be potentially the next big name in the art world, whether a rising artist or a historically significant one waiting to be discovered.