Are You Truly Diversified?

2022’s market environment has been particularly tough for both stocks and bonds. At times of market volatility, it can seem like there is no way to protect your portfolio returns. However, one tried and true method for protecting against major losses is ensuring your investment portfolio is diversified.

Despite being one of the best ways to hedge against market volatility, only one third of Americans successfully diversify their investments.

Are you truly diversified? And if not, how do you achieve portfolio diversification? Here’s what investors should know.

What is Portfolio Diversification?

Portfolio diversification is a risk management technique of distributing investments around so that exposure to any one type of asset is limited. This practice is designed to reduce the volatility of a portfolio over time. Simply put, don’t put all your investment eggs in one portfolio basket.

Why Diversify Your Portfolio?

The aim of diversification is to help limit exposure to significant losses in the market, not necessarily to boost performance. Diversification will not ensure gains or guarantee protection against losses, but it can provide a way to help manage risk.

The basic premise of diversification is to choose investment instruments whose returns haven’t historically moved in the same direction, to the same degree. If there is low correlation between historical returns, even if a portion of your portfolio is declining, the rest of your portfolio could still grow or at least remain stable.

Diversification provides what some financial professionals call a “free lunch” – reducing risk while increasing the potential for overall return. This is because while some assets will perform well, others will do poorly, and the opposite may happen the following year. Regardless of which assets outperform, a well-diversified portfolio has historically earned the market’s average long-term historic return.

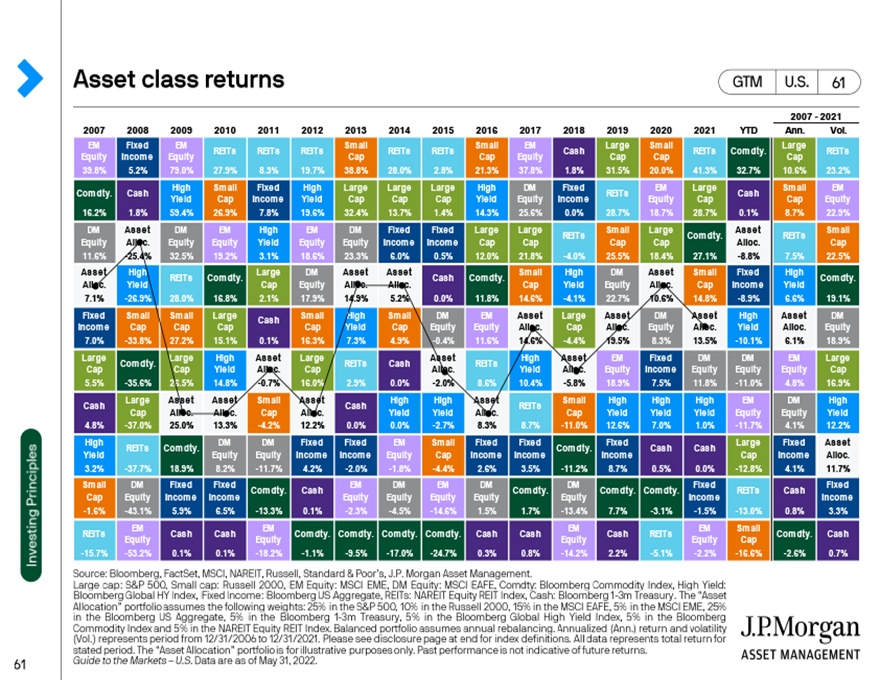

The above graphic from J.P. Morgan shows the variability of different assets from 2007 to 2021. Traced is the Asset Allocation portfolio (a diversified portfolio with a mix of investments) which stays in the middle of the pack. This portfolio achieved an annualized return of 5.7% and the third-lowest volatility of all portfolios from 2007 to 2021. The only portfolios with less volatility are Fixed Income and Cash, both of which have lower annualized returns.

How to Begin Diversifying

Time Horizon

An important step when building an investment strategy is to consider how many years until an investor anticipates needing the money returned. Younger investors are generally going to have longer time horizons, a 25-year-old saving for retirement for example.

An older investor may be investing in hopes of seeing consistent returns to live on after retirement. Someone looking to invest for the next 50 years is going to have a different portfolio from someone looking to invest for the next 10 years. If your time horizon is long-term, you may be willing to take on additional risk in pursuit of long-term growth, assuming there will be time to regain ground lost in a short-term market decline.

An investor’s time horizon is going to be constantly changing as the investment goal approaches. If your retirement is now 20 years away instead of 30, it may be time to reallocate assets.

Risk Profile

Regardless of time horizon, an investor should only take on a level of risk with which they are comfortable. Some people are simply more risk-averse than others, while some people have more money to fall back on if an investment goes south. These factors will play into creating a risk profile for a portfolio.

Aggressive investors generally have time horizons of 30 or more years. This time frame allows for flexibility and therefore higher risk tolerance. These investors may choose to allocate a higher percentage of their portfolio to stocks. Conservative investors are those with little risk tolerance or who need their money in 10 years or less. These investors will often have a higher percentage of bonds in their portfolios.

| Growth | Growth & Income | Income | Inflation Protection | Defensive Assets |

| US Large- and Small-Cap Stocks

Developed Market Large- and Small-Cap Stock Emerging Market Stocks |

US high dividend stocks

International high-dividend stocks US REITs & other real estate investments International REITs MLPs |

Investment-grade municipal bonds

US securitized bonds US investment-grade corporate bonds Bank loans Preferred stocks International emerging market bonds Real estate |

US inflation-protected bonds (TIPs)

Commodities Fine Art & Collectibles |

Cash and cash equivalents

US Treasury securities International developed country bonds Gold and other precious metals |

Figure depicts major asset classes and what they can provide for a portfolio. Note that these are grouped based on how they are commonly used, but each asset can fill multiple roles in a portfolio.

This graph is for illustrative purposes only.

Diversification is an Ongoing Practice

Because financial markets are constantly changing and investors’ objectives may change, it is often recommended that an investor does regular check-ins with their portfolio. An investor, with or without a financial advisor, should evaluate their investments for changes in strategy, relative performance, and risk.

Based on the evaluations, there may be a need to rebalance the portfolio in order to maintain the investor’s risk profile. These check-ins are often recommended to be every year or 6-months, depending on the time horizon of your investments and the market environment.

7 Strategies to Build a Diversified Portfolio

1. Individual Asset Diversification

One basic strategy is to invest in an array of assets within one asset class. This type of diversification is likely the most common as most investors don’t buy shares from just one company to hold.

Investing across an individual asset can be as simple as buying a market index such as the S&P 500 or the Dow Jones Industrial Average. Market indices ensure a variety of high- and low-risk stocks across industries.

A bond portfolio can be diversified by type of issuer, credit quality, and maturity. US government bonds, municipal bonds, and corporate bonds all have different characteristics that will aid in diversification. Credit quality in bonds ranges from high-yield or junk bonds to Treasurys which are considered practically risk-free.

Bond indices are a method for investors to invest in a wide array of bonds from different issuers, with different maturities and different credit ratings. High-yield and investment-grade bonds react differently to moves in the market and can both provide diversification away from stocks.

Mutual funds and exchange-traded funds (ETFs) are examples of investments that already include a diversified portfolio of stocks. Index funds and bond funds also provide this benefit. Funds allow investors to not concern themselves over picking particular stocks, but instead focus on their overall investment strategy and pick funds to match.

Stocks and bonds can also be divided into short- and long-term investments. Diversifying a portfolio’s time horizon is another way to hedge a portfolio against volatility. Short-term investments include money market funds and short-term CDs (certificates of deposit).

Money market funds are conservative investments that offer stability and high liquidity but often see lower returns. CDs are also conservative investments because they are guaranteed by the FDIC, but they offer less liquidity than money market funds.

2. Diversify with Stocks and Bonds

A basic strategy for diversification is to invest in an array of asset classes. These can include traditional investments such as stocks, bonds, and cash, as well as alternative investments.

Stocks and bonds represent two of the largest asset classes. A portfolio with more stocks than bonds traditionally increases growth while increasing volatility. Bonds have less volatility than the stock market, but also generally see less growth. Bonds act as a diversifier because their returns are not highly correlated to the stock market.

Diversifying across asset classes allows a portfolio to have exposure to multiple markets that have low correlations to each other. In investing, a low correlation means that different asset types have not historically performed the same way. For example, when returns on some assets decline, returns on others decline less or even grow.

Historically, the 60/40 portfolio allocation model – 60% of the portfolio in stocks and 40% in bonds – has been seen as the standard; however, some industry thought leaders have called it outdated. To remedy this, other forms of diversification can be implemented.

3. Diversify by Industries and Sectors

Stocks can be classified by sector or industry, and buying stocks or bonds or companies in different industries can provide strong diversification. The Global Industry Classification Standard (GICS) was developed by index providers MSCI and the S&P Dow Jones. The 11 GICS sectors are below and can be divided into 24 industry groups, 69 industries, and 158 sub-industries:

- Communication Services

- Consumer Discretionary

- Consumer Staples

- Energy

- Financials

- Health Care

- Industrials

- Materials

- Real Estate

- Information Technology

- Utilities

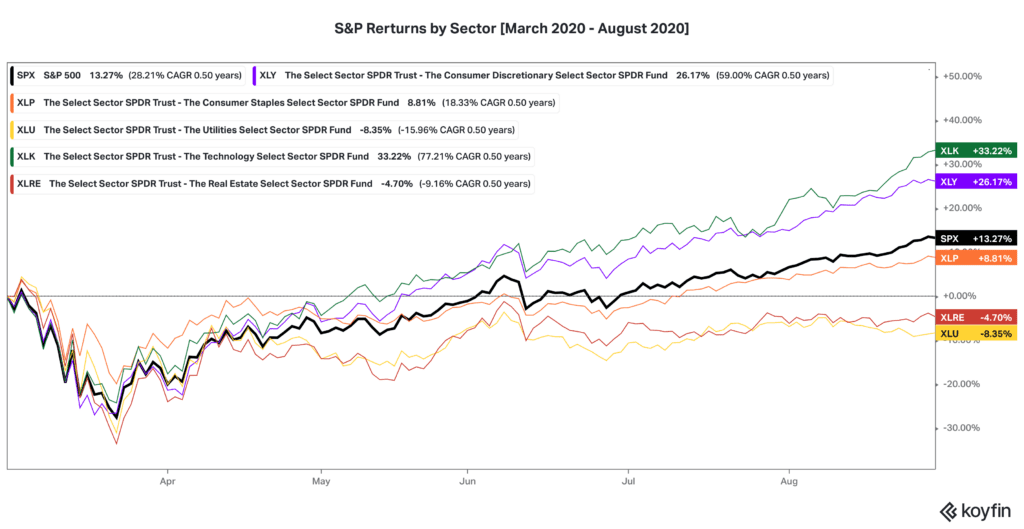

Different sectors react differently depending on the economic cycle, geopolitics, or even just consumer trends. For example, during the first 6 months of Covid-19 lockdowns, the technology, and consumer discretionary sectors far outperformed the S&P 500, while utilities, real estate, and consumer staples sectors all underperformed.

Sectors represented by SPDR Sector ETFs/Koyfin.

These trends make sense based on market trends during the beginning of lockdowns – more people were online, especially online shopping, while forced to be home.

Diversification across sectors could help to mitigate idiosyncratic or unsystematic risks caused by factors affecting specific industries, or even specific companies within an industry. For example, when Facebook posted lower-than-expected quarterly earnings in Q2 2018. The tech-heavy Nasdaq Composite dropped 1% and social media peers Twitter and Amazon fell 3% and 8% respectively, despite posting earnings beats.

4. Diversify by Geography

The location of a company can be an element of diversification. In the investment world, locations are often divided into three categories for US investors: US Companies, companies in developed countries, and companies in emerging markets.

Although global economies are becoming more and more linked through globalization, there can still be l diversification benefits from investing around the world. Companies located in other countries, particularly emerging markets, can perform differently than US-based companies.

Differing policies, economic status, geopolitics, and natural resources can differentiate returns across different countries.

5. Diversify by Market Capitalization

Market capitalization refers to the total dollar market value of a company’s outstanding stock. It is calculated by multiplying the total number of shares outstanding by the share price.

Market capitalization is another method to diversify a portfolio. Generally, small-cap stocks have higher risks and higher returns than more stable, large-cap stocks. For example, research by AXA Investment Managers in 2021 found that small-caps have outperformed large-caps by around 1% a year since 1926.

6. Diversify by Style

Diversification across companies at different stages of the corporate life cycle can help mitigate systemic and idiosyncratic risk. Fast-growing companies have different risk and return characteristics than more established companies.

Growth companies include firms that are rapidly growing their revenue, profits, and cash flow. These firms tend to have higher valuations relative to reported earnings than the overall market. High valuations, or high P/E ratios, are justified by investors because of rapid growth.

Corporations that are established and stable, often blue-chip companies, are considered value companies.

7. Add Alternative Investments

Alternative investments refer to any investment outside of traditional markets – stocks, bonds, and cash. Some of the most common types of alternatives include

- Hedge funds – Pools the capital of many investors and invests it across various securities in hopes of outperforming the market rate of returns. This asset is often reserved for high-net-worth investors.

- Private equity – The investment in private companies. This asset includes venture capital, growth equity, and buyouts.

- Real estate – the investment in residential, commercial, or retail properties. This asset can be purchased either individually or through a real estate investment trust.

- Commodities – Commodities refer to natural resources such as oil, agricultural products, or timber.

- Fine Art and other Collectibles – Fine art along with rare wines, baseball cards, or fine jewelry can all be investment vehicles if purchased with the intention of selling them when their value appreciates.

- Structured Products – these investments involve fixed-income markets and derivatives.

Alternative investments are a tool of diversification because they tend to have a low correlation with traditional assets. According to Citi Private Bank Research, hedge funds have only a 0.77 correlation with developed equities, 0.52 for real estate, 0.11 for commodities, 0.09 for fine art, and -0.04 for Post-War & Contemporary Art.

J.P. Morgan’s 1Q 2022 “Guide to Alternatives” noted that allocating just 30% to alternatives in a portfolio can potentially increase returns, while also strengthening stability and minimizing risk in a portfolio in this economy.

Keep in mind that alternative assets are often less liquid than stocks and bonds, or funds made up of stocks and bonds.

Are There Risks to Diversification?

Although diversification is one of the best ways to help lower portfolio risk without sacrificing returns, there are still downsides to consider. First, diversification is not a guarantee for your investments. A perfectly diversified portfolio can still generate losses depending on the market environment.

Also, it is possible to over-diversify your portfolio. Spreading your cash across too many investments may cause you to miss out on growth. For example, if you only have $1,000 to invest and you choose 5,000 different stocks, one stock skyrocketing is not going to do much for your overall returns because the initial investment was so small. On the other hand, if you invested that same $1,000 in just 50 stocks, you would earn significantly more if one should do well.

The main risk to consider is something that no amount of portfolio balancing can fully protect an investor from market risk. Even if investments are spread among different markets and include assets not tied to the overall market, there is still a risk of a general market decline.

Diversification and asset allocation do not ensure profit or guarantee against loss. Investing involves risk, including loss of principal.