What is Euro-Dollar Parity? Why Does it Matter?

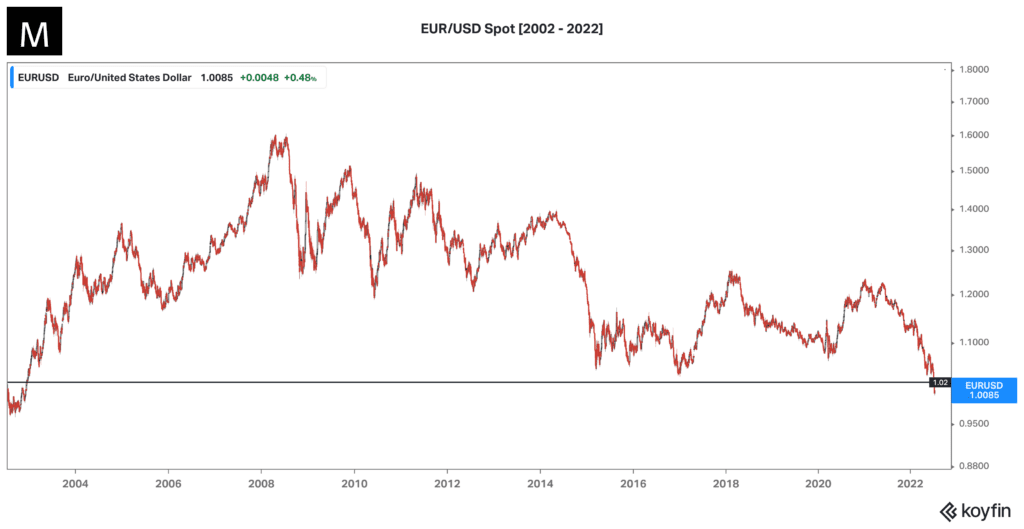

The exchange rate between the euro (EUR) and the US dollar reached parity for the first time in 20 years on July 13th 2022, meaning the two currencies are worth the same amount.

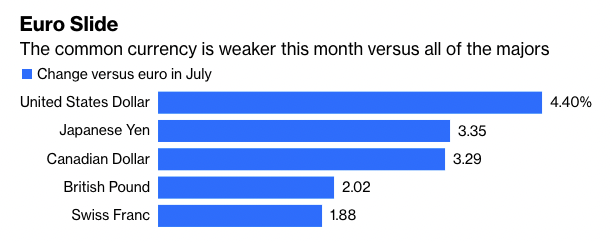

The euro hit $1 on Tuesday and slumped to $0.9998 on Wednesday, losing 12% since the beginning of 2022. This rapid depreciation came less than two years after ECB policymakers were concerned about excessive euro strength leading to economic deflation.

Today, the ECB faces a new beast: a dramatic weakening in their currency and consumer prices surging.

EUR/USD Exchange Rate Explained

You may be familiar with foreign exchange rates if you’ve ever traveled abroad. Put simply, an exchange rate is the value of one currency compared to another — in this case, the value of the euro versus the value of the US dollar. The currency pair EUR/USD indicates how many US dollars are needed to purchase one euro.

In foreign exchange (or forex) trading, investors exchange one currency for another in order to hedge a portfolio or profit from speculation. Interest rates, trade flows, tourism, geopolitical risks, and national economic strength all impact the supply and demand for currencies. Investors who trade forex have the opportunity to profit from changes that may bolster or weaken one currency’s value compared to another.

The EUR/USD pair is the most widely-traded pair in the world, representing a combination of two of the largest global economies. One of the leading factors that impact the EUR/USD pair is interest rates, or the interest rate differential between the European Central Bank and the Federal Reserve.

Why is the Euro Slumping?

The euro has been on a consistent decline since May of 2021 when 1 euro was equal to $1.22 USD and has seen a drastic fall since February 2022 from $1.13 to $1.00.

Russia’s war in Ukraine was a catalyst for the most recent decline as Russia threatens to cut off gas supplies to Western Europe. Prior to Russia’s invasion of Ukraine, the European Union received approximately 40% of its gas through Russian pipelines. This energy crisis happened amidst an already occurring economic slowdown.

Experts have said the European Central Bank (ECB) acted too late when it began raising rates in July of 2022.

In June 2022, the ECB announced it would raise rates for the first time in over a decade starting in July in order to curb rising inflation. After a decade of low inflation, the eurozone reported an inflation rate of 8.6% in June 2022, the highest rate since the creation of the euro in 1999.

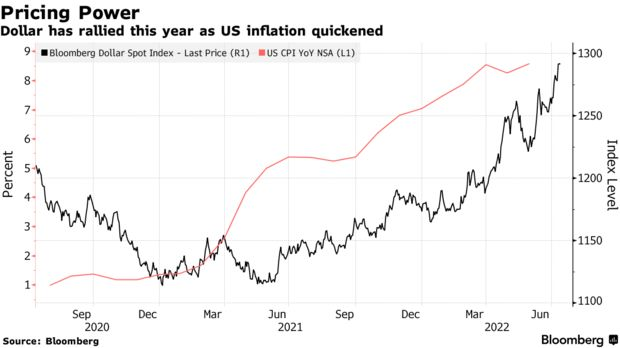

As the euro struggled, the US dollar has surged with the US dollar index increasing to 16% over the past year this week, despite inflation rates and lower domestic purchasing power. Facing high inflation in the US – reaching an annual increase of 9.1% in June – the US Federal Reserve is raising interest rates much faster than the euro area.

In fact, the ECB is behind most other major global currencies in regard to interest rate hikes. More than 50 countries have raised official rates by at least 50 basis points in 2022 so far with the US Fed raising rates by 150 basis points with plans to continue tightening.

Some experts have claimed the ECB is too far behind the curve and that slowed growth is all but inevitable. Some impacts have already been seen, for example, Germany recorded its first trade deficit in goods since 1991 in early July as fuel prices and supply chain issues significantly increased the price of imports.

As US interest rates drive higher, yields on US Treasury bonds have risen higher than those on Europe’s debt, incentivizing investors away from the euro and towards the dollar.

Why is the US Dollar Surging Against Other Currencies?

Demand for USD has been consistently strong in 2022, with its value surging 9.4% from June 2021 to June 2022. How is this possible amidst rising inflation in the US?

First, rising US interest rates have drawn more investor interest in the dollar.

As the Fed raises rates at a faster pace than other economies, the return on savings and bonds is more attractive in the US. International capital tends to flow to the US when rates are high, resulting in the dollar’s appreciation.

Secondly, the S&P was down 8.39% in June 2022, bringing its year-to-date return down to -20.58%. As equities tank in the US, demand for “safe haven” assets increases, drawing more investors at home and abroad to purchase the US dollar.

While a strong dollar is good for Americans traveling to Europe, if the dollar becomes too strong it could harm American businesses by making exports too expensive for foreign buyers. If that happens and sales of US exports decrease, that could further slow down an already slowing US economy.

Why Does Euro Dollar Parity Matter?

The rarity of euro dollar parity is part of what makes it important, since the euro’s creation in 1999, it was only been at parity or below between 1999 and 2002, sinking to a record low of $0.82 in October 2000. Within the currency’s relatively short history, the euro is the second-most sought-after currency in global currency reserves and the daily volume in EUR/USD trades is the highest among currencies in the global forex market.

Classic economic theory has pushed policymakers in many countries to welcome weaker currencies as a means to stimulate economic growth as it makes their exports more competitively priced.

However, with inflation in the eurozone at record highs, currency weakness only works to diminish price gains by making imports more expensive. Some policy experts in Europe have cited a weaker euro as a risk to the central bank’s goal to return inflation to 2%.

European consumers will likely feel the brunt of a weakened euro, especially as it only feeds more into the already skyrocketing inflation rate.

Who Benefits From a Weaker Euro?

The euro’s weakness against the dollar helps European exporters because it makes products more competitive and boosts earnings. The United States accounts for more than 40% of sales for 70 large-cap European companies.

Americans traveling to Europe will be thankful for a more attractive exchange rate. American tourists will find cheaper hotels, airline tickets, and a generally lower cost of goods while traveling.

Who is Hurt By a Weaker Euro?

US corporations doing business in Europe will likely see revenue shrink due to a less attractive exchange rate once earnings are returned to the US.

A key concern for the U.S. is that a stronger dollar makes U.S.-produced products more expensive in international markets. This widens the trade deficit and reduces economic output while giving foreign products a price edge in the United States.

A weaker euro can signal trouble for the European Central Bank because it can lead to higher prices for imported goods, particularly oil, which is priced in dollars. The ECB is already facing a variety of concerns from existing inflation issues: the typical solution for high inflation is raising rates, but higher rates have the potential to slow economic growth, leading to concerns about stagflation.

Looking Forward

Some economists are predicting the euro will slide lower – Nomura has a short-term target price of $0.95. Most analysts say that until the economic outlook improves, the euro will remain below or at parity with the dollar. Unless the ECB hikes rates in line with the Fed, cash will continue to flow into the United States.

On the bright side, shorting the euro is already a popular trade in currency markets with bearish positioning approaching historic levels. This could prevent the euro from falling more sharply.

So far, the ECB has downplayed euro weakness by arguing they have no exchange rate target. To bolster the euro, the ECB could signal more aggressive tightening, including a 50-basis-point rate hike in September, and further moves in October and December.

Analysts note a more hawkish stance from the ECB is unlikely given the current outlook of continued economic slowdown.