Tail Risk: Understanding the Odds of Investment Losses

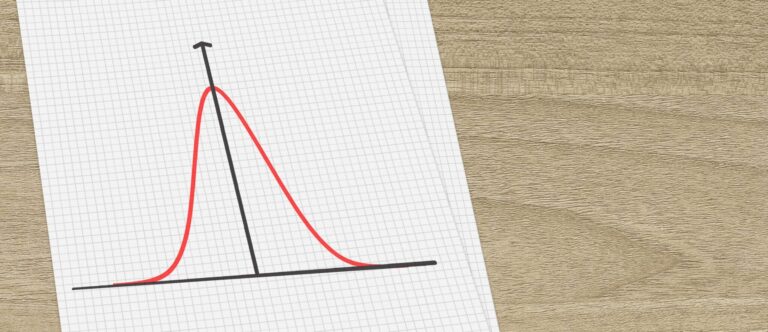

What is Tail Risk? Tail risk refers to the chance of portfolio losses caused by rare events, as shown by a normal distribution curve. It’s the risk of an investment’s returns being much lower than expected. This is often caused by unexpected events with a low likelihood of occurrence but large impacts, such as natural […]

Read More